By the end of 2008, under the name of Satoshi Nakamoto, the whitepaper of Bitcoin was published. This whitepaper contains the origin of a new system to register transactions. Bitcoin is defined as a p2p protocol based on blockchain technology. This protocol allows a decentralized system, fast and secure for recording transactions. Furthermore, thanks to being 100% digital, it can be used by any users along the world, without any physical barriers. Some years later, this system has become the new digital gold for a large number of people.

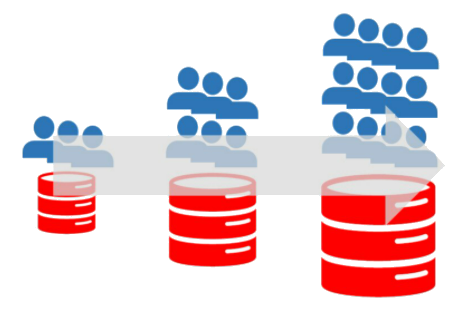

Actually, Bitcoin works as a system to register transactions (a network) with a revolutionary technology. Every transaction is grouped with others in something called “block”, and every block is linked with the others, forming a chain. This chain of information is shared among the users and it is public for every participant in the network. Therefore, Bitcoin works as a huge database where no one owns the control but the network itself.

What is Bitcoin?

Bitcoin is, at the same time, a software, a protocol and a currency (a cryptocurrency to be accurate). Firstly, it is a software that, once downloaded and installed, transforms your computer in a node of the network. This software is open source, as it is available for the public to be checked and analyzed. Additionally, this software allows trading and registering of any execution allowed in Bitcoin network. In the same way, the software includes a wallet which manage the bitcoins and verify the transactions.

Secondly, Bitcoin (with “B”) is a protocol including all the working rules of the network. This means that the protocol includes the definition of the consensus protocol as well as the issuance rules. This protocol is where the blockchain technology is applied, by which all the transaction blocks are linked, forming a chain of traceable information (that is where name of “blockchain” comes from).

Last but not least, bitcoin (with “b”) is the token used within the Bitcoin protocol. It is also the currency which the transactions are based on. Both the protocol and the software are the necessary support for the currency to work properly. This currency was designed as universal, secure and decentralized mean of payment, thanks to the blockchain technology. The idea behind the currency was to substitute the current system of payment, based on currencies issued and controlled by Central Banks. In fact, this is the reason why Bitcoin is also known as the “currency of the people”.

How it works?

The Bitcoin protocol works based on three basic factors: cryptography, decentralization and the consensus protocol. The cryptography is used to guarantee the privacy of the transactions, and it works as a system of two keys, private and public. This is similar to the banking accounts work. Every user has a public key which can be publicly shared. Additionally, the user has a private key that should not be shared, and which is linked to the public key.

This way, when someone sends bitcoins to other user, he does it by using the public key of the receiver. The receiver can use the private key to access his/her account and see the money. Therefore, the transactions are secure, and the users can manage their funds while the private key remains available. Furthermore, the identity of the users remains unknown, because their identity is hidden behind the public key.

The Bitcoin protocol works in a decentralized way because all the nodes have the same power in the network. The transactions are confirmed by every node, and the issuance of new bitcoins is defined in the protocol. This way, a reliable third party is not needed, and all the participants in the network are responsible for the validity of the existing information.

The last differentiating element of Bitcoin is the consensus protocol. This algorithm is the method the network uses to validate the transactions and to reach consensus among the participants. Through the algorithm “Proof of Work”, the participants agree on the current status of the network, confirming all the included transactions. If the participants do not agree, the status of the network remains without update.

Bitcoin issuance

The issuance of bitcoins is the process by which more units (or tokens) of the currency enter in circulation. The traditional equivalent process is the impression of more paper money from the Central Bank and the later injection into the economy. As defined in the Bitcoin protocol, the maximum number of bitcoins to be issued is 21 millions. With the current issuance system, it is expected that this number will be reached in 2140, although more than 90% has been already issued. Due to halving, the issuing rhythm is decreasing over time, so in the last years the new units will be just a few.

It is, therefore, a non inflationary system. The issuance is limited and defined, and the users know how many bitcoins there will be at any moment. This avoid the inflation, so frequent in the traditional systems from fiat money. Additionally, the decreasing rhythm of issuance maintains the valuation of bitcoins quite high, because the demand grows at a higher rate than the offer.

However, the fact of a limited issuance has a very significant disadvantage. Many users of Bitcoin have lost their private key, which means that they can not longer to access their funds. As there are not other ways to access the account, the funds are essentially out of circulation. It is not easy to estimate the number, but almost the 20% of the issued coins are in this situation. This causes than, in fact, the available number of bitcoins is significantly lower than the issued one.

Bitcoin consensus protocol. Proof of Work

The consensus algorithm is the system of the network to reach consensus among the participants. The algorithm for Bitcoin is called the “Proof of Work” and it is considered as one of the safest if the existing protocols. The algorithm works as a mathematical test that every node in the network must try to solve. The node who solve it is the winner, and for that receives a reward in newly created bitcoins.

This mathematical test (which is based on the hash function) is harder to solve when the number of nodes increases. Because of this, the algorithm requires a high computational power, which is expensive and not available for everyone. A high computational power requires a proportional energetic cost so the computers remain working. This is the reason why the algorithm is so expensive to develop. Furthermore, this process slows the resolution of the test, which is worse in terms of scalability. However, the high cost is simultaneously one of the reasons for the safety of this algorithm.

The Proof of Work is designed so every node in the network behaves honestly. The protocol requires a complete consensus, so it is not easy that any node behaves maliciously. If one transaction should not be added to the chain because it could cause problems of double spent, then it will not be validated. The nodes must have the support of, at least, the 50% of the network to add any transaction. As this means a high cost because of the algorithm, this situation is very unlikely for mistrades. In the current state of Bitcoin, with so many connected nodes, is really hard to find problems of this nature.

Mining in Bitcoin

The mining of bitcoins is the process of creation of new coins. Every time one node want to add a block into the blockchain, it must solve the Proof of Work. When the node solves the test, the network sends the solution to the rest of nodes, and they confirm the validity. After that, the initial node will receive a reward of newly issued bitcoins. This reward is fixed by the protocol and it decreases over time. The reward is added to the fees of the transactions included in the block, and the block is added to the network.

Therefore, the mining is basically the process of issuing new bitcoins. The validating nodes are also called miners, and the must have enough computational power to solve the consensus protocol in 10 minutes as maximum. In fact, the the difficulty of the algorithm does not allow the nodes to solve the test, the level of difficulty is readjusted automatically by the network.

Once the block has been mined, the process finishes and the miners start again with a new block. The blocks have a maximum size defined by the protocol, and the difficulty of the algorithm is adjusted automatically. Additionally, every block has an identifier which creates a link with the previous one. This allows the information to be perfectly coherent and traceable. All the blocks are unchangeable once they are registered. This way, the protocol guarantees a reward for the miners, assuring simultaneously the safety of the network.

Achievements and challenges

Now that we know what Bitcoin is and how it works, it is time to analyze the challenges to overcome. If Bitcoin is safe, decentralized and anonymous, what else does it need to become the new global payment system? First of all, Bitcoin has a problem with scalability. The size of the blocks and the difficulty of the consensus algorithm causes than the network is not able to process more than 7 transactions per second. This is far away from the traditional systems, which are able to process much more volume of transactions per second.

Additionally, from a regulatory point of view, Bitcoin is seen as a threat for the financial system. The absence of control by the financial authorities has caused multiple restrictions in many countries. This is a significant obstacle in regions like China, where is located a big part of the mining power.

However, it is true that Bitcoin has achieved several goals since its origin. Technically the network has improved the scalability thanks to the payment channels as Lightning Network. In terms of acceptance, some countries have approved Bitcoin as the official mean of payment, and so are doing many companies all over the world. This is also the case in the financial sector, where both retail and institutional investors have predicted a great potential. In fact, Bitcoin has become one of the assets with the highest performance in the last years.

All this has allowed the appearance of many other projects linked to new cryptocurrencies. At the end, this growth implies higher acceptance for the public and better legal recognition by the authorities.

The environmental conflict of Bitcoin

One of the biggest challenges that Bitcoin must confront has to do with the environmental cost. Due to the Proof of Work algorithm, the mining process of Bitcoin is very expensive in terms of energetic cost. Most of the mining companies say that the energy they use comes from renewable sources. However, the truth is that the energetic cost of Bitcoin is higher that the energetic consumption of many small or medium size countries.

Moreover, there is a hot discussion about the utility of this energetic expense. The Proof of Work algorithm means basically to solve a puzzle in order to validate the transactions, but the necessary energetic cost to do it does not add any value to the society. Therefore, many people think that this energetic consumption is a waste of resources that should not be allowed.

In fact, several cryptocurrencies which use the same algorithm are thinking about change to other one less energy expensive. This is the case for Ethereum, which for the last years have been working to transform the platform from PoW to PoS. Therefore, this environmental conflict is still open for Bitcoin, and it has no easy solution.

Conclusion

Bitcoin is, as we have seen, a mean of payment based on a revolutionary technology. The blockchain allows that all the information registered is public and available for everyone. Furthermore, the consensus algorithm maintains the safety of the network and rewards the miners. The issuance rules create a non inflationary process while the valuation of the coins remains high. To sum up, Bitcoin is a mean of payment safe, fast and decentralized.

However, the process is not scalable enough, which is a handicap to become a global mean of payment. Moreover, it is not legally recognized in most of the countries, and it is better known as investment than as payment system. Because of this, we cannot say it has fulfilled all the goals, although it has clearly gained a seat in the financial industry.

Therefore, Bitcoin has still a great margin of improvement, both social and technical. Several companies have developed different solutions related with cryptocurrencies and blockchain, which highlights their value. Because all that, it is important to recognize the merit of Bitcoin.